ETFMandate Market Insights

Be up to date with my latest Insights

China’s economy grew by 5.2% in Q2 2025, slightly above the 5.1% consensus forecast, but down from 5.4% in Q1. This signals continued but slowing growth momentum. However, retail sales grew only by 4.8% YoY (estimated 5.6%), down from 6.4% a month ago while industrial production topped forecasts growing 6.8% (estimated 5.6%), up from 5.8% a month earlier.

In the US, the June CPI report showed a modest rise in inflation. Headline CPI increased to 2.7% YoY (vs. 2.4% in May), just above expectations. Core CPI remained unchanged at 2.9%, matching forecasts.

Markets: Asian equities mixed this morning, European equities lagging, US futures positive while yields are unchanged and US dollar gains - cryptos and gold see some price drop.

My view: China’s beat is statistically welcome, but the deceleration in consumer growth highlights some existing fragilities. In case needed, the government will selectively add some stimulus to support a growth rate around the 5% target.

The rise in June inflation is not alarmingly, however could reinforce hopes that rate cuts remain on the horizon. In my view, Fed narrative remains “higher for longer” why markets may need to adjust overly dovish rate cut bets.

From a valuation and risk-return perspective, China currently looks more attractive than the US. While sentiment on China remains weak, it offers better upside potential with limited downside, particularly for patient, contrarian investors. Meanwhile, US equities appear priced for perfection, and are vulnerable to disappointment, especially if inflation stays sticky and rate cuts get delayed further.

The White House has issued fresh tariff letters during weekend, announcing 30% duties on exports from the EU and Mexico, effective August 1, 2025, adding to earlier measures on other countries.

In response, the EU has postponed retaliatory tariffs on EUR 21 billion of US goods to maintain negotiation leverage, while preparing a wider package as a countermeasure.

Markets: European equities slightly down - US indices trading sideways with long-term yields almost unchanged as well as the US dollar - gold giving up earlier gains - Bitcoin reaches new all-time high with USD 123’200

My view: Markets are brushing off tariff risks, for now. Despite the seriousness of the tariff moves, investors are maintaining a surprisingly relaxed stance, assuming Trump will soften again (TACO: Trump Always Chickens Out). But the tariff train has left the station, and the damage may not be visible immediately. Companies are on hold with new investments since some month with all uncertainties around the tariff topic.

All these measures come during a period of already stretched valuations and reaching a euphoric sentiment. I see asymmetrical risks ahead: limited upside from here, while the downside, if tariffs are enforced or retaliated, could be sharp. I remain cautious, keeping hedges in place and stops tight. Market calm may be deceptive.

Another day, another all-time high:

NVIDIA becomes the first company ever to reach a USD 4 trillion valuation

US indices hit fresh highs, led by Tech stocks

Bitcoin climbs to a new record

FTSE 100 index (UK) touches an all-time high this morning, powered by mining stocks

Markets: Global stock indices up (Asia, Europe) - US Futures sideways after the rally - US dollar, long-term yields, cryptos flat - gold back above USD 3’300/oz level.

My view: Markets keep breaking records. But this rally is increasingly fueled by speculative momentum, not fundamentals. The current pattern is not a healthy move and resembles classic euphoria territory: bad news is ignored, risks are discounted, and nearly every stock moves in just one direction, up.

A more cautious stance starts to be warranted. We're likely in the overshooting phase, which can persist longer than expected. But when reality bites, corrections tend to come fast, and could be even hard.

Personally, I’m not chasing the final stretch. The risk-reward ratio is no longer attractive. With an anti-cyclical stance, I believe it’s time to: Tighten stops, reduce exposure and take some chips off the table.

US President Donald Trump is targeting a new market in his global trade war: copper. He announced plans to impose a 50% tariff on copper imports, triggering a sharp reaction in commodity markets. Copper futures in New York soared, posting their largest intraday gain in decades following the announcement.

While Trump did not provide a precise implementation date, he suggested the tariffs could be enacted within the next 12 to 18 months.

Markets:Copper futures jumped more than 10% yesterday in New York - no impact on other precious or industrial metals - most posting small declines today.

My view: The commodity sector is back in the spotlight. While gold has been a focus for several years, attention has increasingly shifted to other metals and rare earths since April this year.

The global fight for resources is intensifying. China, the world’s largest producer of rare earths, is tightening export controls. Only a comprehensive trade deal with the US could ease some tensions. Rare earth elements are critical across the technology spectrum, from electric vehicles to military applications.

The market’s reaction to the copper tariff news has been strong. Yet, considering limited global supply and rising structural demand, copper prices together with other metals with a supply deficit like platinum may still have room to climb. That’s why I continue to hold my copper exposure together with other metals like platinum, silver and gold.

I’ve built most of this commodity exposure over the past few months, particularly following Trump’s announcement, planning a rare earth deal with Ukraine, which I interpreted as a clear signal: the global race for limited resources is accelerating.

Position Disclosure:

- Copper ETF (3x leveraged) Performance sind last buy: 102.9% - 09.04.25

- Silver ETF (3x) 66% - 09.04.25

- Platinum ETF 45.8% - 09.04.25

- Gold ETF 0.3% - 20.05.25

- Gold Miners ETF 13.9% - 20.05.25

- Global Miners ETF 21.0% (net) - 26.02.24

- Rare Earth Miners ETF 7.2% (net) - 28.02.25

- several mining stocks (not specifically mentioned here)

President Donald Trump yesterday announced a new round of unilateral tariffs affecting 14 countries, set to take effect on August 1. Among the major trading partners, Japan and South Korea received the most favorable treatment, each facing a 25% tariff. Other countries were assigned rates ranging up to 40%.

All tariffs have now been synchronized to the August 1 implementation date, giving countries a limited window to negotiate more favorable terms before the deadline.

In response, the European Union is reportedly seeking a preliminary agreement with the US in an effort to secure a 10% tariff rate that would remain valid even beyond the August deadline.

Meanwhile, like many EU countries, Switzerland is still awaiting its official tariff letter from Washington.

Markets: Asian equity indices up during the last trading session - European and US equities trading sideways while long-term yields are rising - US dollar weaker - gold price remains above USD 3’300/oz.

My view: Despite the latest tariff announcement from President Donald Trump, investor sentiment remains largely unconcerned. With the new implementation date now pushed to August 1, markets have effectively been granted another 23 days to ignore the issue. Trump had previously marked July 9 as a hard deadline - now postponed. Is this yet another case of "TACO" (Trump Always Chickens Out), or just a “semi-TACO” delay?

One thing is clear: a day will come when tariffs are defined and enforced. The US needs additional revenue to fund the “Big Beautiful Bill,” which includes substantial tax cuts. Betting on a world without tariffs is therefore redundant. The real question isa: who will ultimately pay the price? Consumers or corporations? That answer will only emerge in the months ahead.

While the August 1 deadline buys time, it does not buy certainty. Markets remain priced for perfection, with investor positioning still reflecting high levels of optimism. That complacency leaves room for a sharper correction if reality falls short of expectations.

Donald Trump has confirmed that letters outlining new unilateral tariffs will be delivered to 12 key trading partners starting today, Monday at noon Washington time. These letters are said to include “take it or leave it” offers, essentially marking the final stage of negotiations.

The deadline to reach a deal remains set for July 9, with tariffs scheduled to take effect on August 1.

Trump has warned that countries failing to strike an agreement could face tariffs reverting to the levels proposed back in April. Meanwhile, Treasury Secretary Scott Bessent suggested that some countries may be granted limited flexibility to finalize agreements, but no official extensions have been confirmed. Major partners like the EU, Japan, and South Korea are still negotiating under growing pressure.

Markets: Most equity indices are trading sideways, US Futures slightly negative, US yields up together with the US dollar, commodities (metals) fall slightly while cryptos remain stable.

My view: The August 1 start date gives markets more time, but not more certainty. What matters most is the tariff rate each country finds when they open their letter. I believe markets are still underestimating Trump’s determination. Should tariffs be implemented as outlined, Trump mentioned a 70% tariff rate last week again, the market reaction could be swift and negative. However, in the days ahead, any last-minute deals may spark short-term relief rallies.

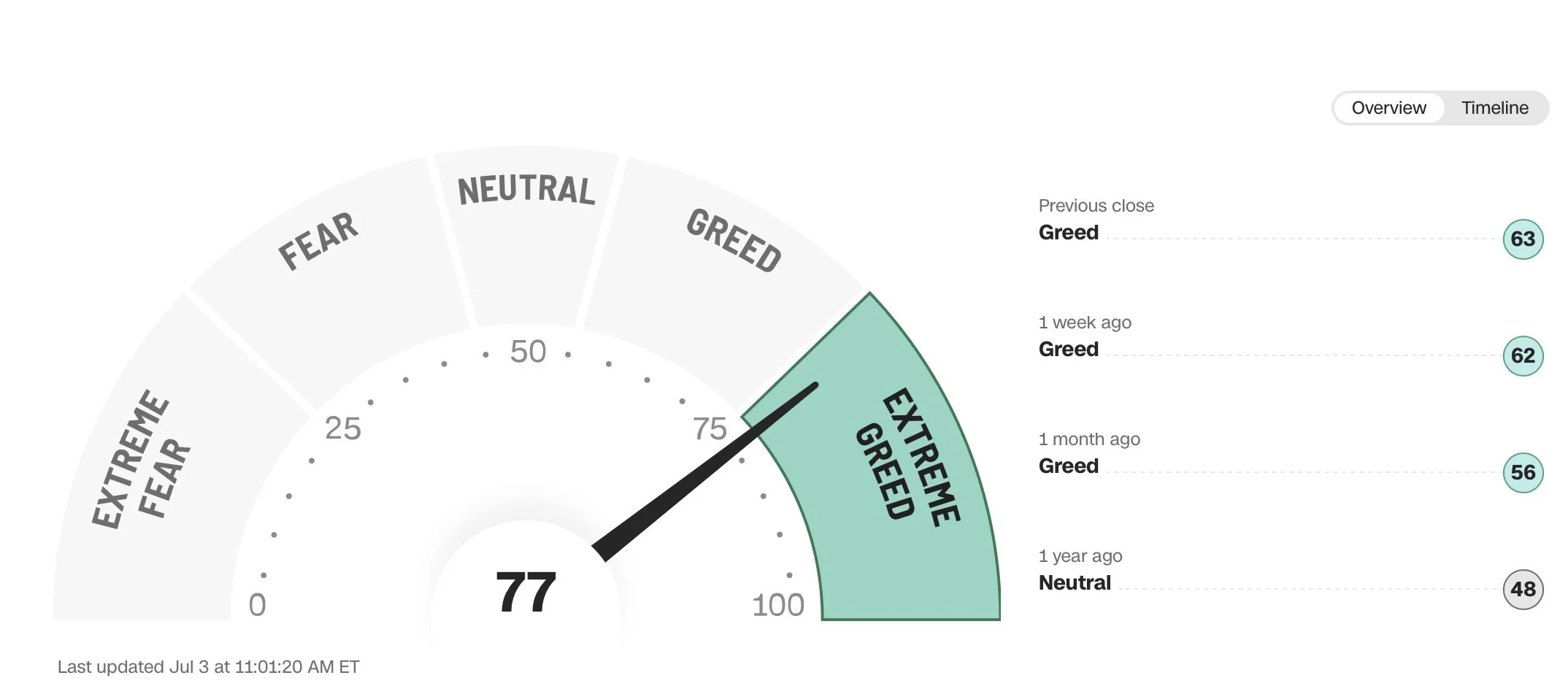

One more factor to keep in mind: investor sentiment has reached “Extreme Greed”, a classic contrarian signal that often precedes market turning points.

In a shortened trading session ahead of Independence Day, US equity markets surged to fresh record highs — marking the fastest recovery in history since the April lows, even surpassing the pace of the 1998 rebound. That year, incidentally, also marked the start of my first market experiences.

What Drove Markets Today:

1. Strong Labor Market Data:

Latest figures once again confirmed the resilience of the US job market:

Unemployment rate: 4.1% (vs. 4.2% expected)

Nonfarm payrolls: 147k (vs. 110k expected)

Initial jobless claims: 233k (vs. 240k expected)

2. Political Momentum:

The much-discussed tax and spending proposal, dubbed the “Big Beautiful Bill”, featuring tax cuts, immigration funding, and the rollback of Biden-era green energy incentives, appears to be clearing its final legislative hurdles as the news just dropped in this moment that the house passed it.

3. Sentiment & Speculation:

Momentum and optimism dominate the current phase. The ongoing “TACO trade” (Trump Always Chickens Out) in combination with retail-driven flows overpowering cautious institutional positioning has pushed the CNN Fear & Greed Index back into “Extreme Greed” territory, a level briefly reached last October.

Markets: US indices closed at all-time highs, while the US dollar and bond yields saw a modest bounce heading into the holiday.

My view: As I’ve outlined in previous blog posts and Market Insights, extreme sentiment levels can serve as powerful contrarian signals. When the market enters “Extreme Greed,” the probability of a pullback or consolidation increases. While speculative phases can stretch further than expected, these moments often mark a good time to consider taking some profits.

With the trade deal deadline just a few days away, investors may soon face a reality check: the underlying macro picture is not as flawless as current index levels suggest.

How I’m Aligning the Portfolio to Current Market Conditions

For positions that have performed well recently, I’ve set stop levels to protect gains in case the market turns, adjusting levels up on a regular basis.

At the same time, I’ve taken measures in recent weeks to benefit from a potential correction, increasing short positions and adding long exposure to volatility.

Stay tuned to ETFMandate. I’ll continue to keep you informed with sharp, timely updates on what truly matters for your investment decisions and your portfolio.

Last night, US President Donald Trump announced a preliminary trade agreement with Vietnam. Based on early released details, the deal includes:

A 20 % tariff on Vietnamese exports to the US, down from an initially proposed 46% during “Liberation Day”.

A 40 % tariff on trans-shipped goods, aimed at blocking rerouted Chinese exports.

Zero tariffs for US exports into Vietnam.

There is no final implementation date yet. It is a framework deal with further negotiations pending.

Markets: after latest rally, Vietnamese stocks declined after the announcement and the currency weakened - short-term positive reaction on some apparel stocks exposed to Vietnam (Nike, On Holding, Lululemon)

My view: On first sight, the newly announced tariff deal with Vietnam appears less severe than initially feared. The originally proposed 46% tariff was scaled back to 20%, offering some relief. However, this remains a net negative for Vietnamese exporters: costs are still rising, and competitive pressure within the region will intensify as global buyers may reassess supply chains.

For context, markets prices in an average US tariff level of roughly 15%. We have now UK with 10%, China 55% and Vietnam 20%.

The Vietnam agreement marks deal number three out of 90, as part of Trump’s “America First” strategy to restructure global trade away from China and bringing production back to the US. There are only six days remaining until the July 9 deadline. Hopes for a wave of last-minute deals are not fading yet. Clearly, the number of concluded agreements is far below what markets had anticipated just weeks ago.

Will Trump extend the deadline? He stated firmly: no. Will he hold the line this time?

Markets are still betting on the so-called TACO trade — Trump Always Chickens Out. By now, the speculators got the reward for taking the risk. Will it soon going to be different?

For me, this is clearly not the end of tariff risk. The latest deal may support short-term market optimism, with hopes rising for more agreements to follow during the next days. However, under the surface, the risks and negative side effects from already-announced or soon-to-be-implemented tariffs implemented tariffs remain. The structural damage may still unfold over time, especially in terms of inflation, supply chain realignments, and corporate margins.

Position Disclosure:

I am invested in Vietnam via an ETF with a long-term investment horizon.

After the first clash in early June, Elon Musk attempted to de-escalate tensions on June 11, posting on X that he “regrets some of his posts… they went too far.”

For context, revisit the original analysis: Trump vs. Musk, published 6 June 2025 in ETFMandate Market Insights.

But today, the feud reignites.

President Donald Trump publicly accused Elon Musk of profiting excessively from EV subsidies and hinted that the Department of Government Efficiency should investigate. This came shortly after Musk threatened to increase political donations against Republicans backing Trump’s new tax bill.

Markets: Tesla stock is sharply lower, trading around USD 300, down more than 5%.

My view: While this story is unlikely to drag broader markets lower on its own, it does have an impact on the index due to Tesla’s significant weight as part of the Magnificent 7.

The disagreement highlights deeper tensions around US fiscal policy. The proposed tax bill and the persistently high US debt levels are critical themes that could shape markets in the near to mid-term. I’ll continue to monitor developments closely. As always, ETFMandate will keep you informed in real time.

Negative news around Tesla continues to pile up. Latest delivery figures confirm a persistent sales slowdown. The much-hyped robotaxi vision is facing delays and technical issues with no clear sign of near-term monetization. This is far from what bullish investors had hoped for.

Position Disclosure:

As mentioned before, I initiated a short position on Tesla 20 May 2025 at USD 353.63. A transaction instantly communicated to ETFMandate Premium Members via the Premium Newsletter.

US markets are continuing their upward momentum as traders grow increasingly optimistic about the likelihood of trade agreements being finalized in the coming days. Despite the lack of substantial confirmed details, recent moves suggest positive sentiment. Canada, in an attempt to restart trade talks, has scrapped tariffs on major tech companies, signaling a potential thaw in relations after President Trump halted trade negotiations with the country last Friday.

Markets: US markets continue to outperform major indices while US yields are falling - Gold is up while cryptos are losing some ground - US dollar is weak while Swiss franc continues its uptrend

My view: The rally in US equities continues to be fueled by growing hopes of a swift resolution to ongoing trade negotiations. However, with the deadline fast approaching and limited concrete information available, I remain cautious. Market movements are currently driven more by speculation and sentiment than by confirmed policy outcomes.

At these elevated levels of pure optimism, markets become increasingly vulnerable and could react sharply to any negative news.

Even the SNB lowered interest rates to 0% in June, there is ongoing demand on the currency. The strength of the Swiss franc suggests some risk-off sentiment in global markets, potentially signaling a flight away from the US dollar. Investors may be beginning to question the sustainability of US household spending and the ongoing debate over the "Big Bill" in Congress, which could have significant fiscal implications.

In the short term, while there may still be room for upside driven by optimism, the risks surrounding trade deal uncertainties and geopolitical tensions should remain front of mind.

Additionally, I believe tariffs will persist, and investors may be underestimating the inflationary pressures that could arise, leading to upward pressure on interest rates in the near future.

Markets have once again climbed to fresh record highs, with major US indices extending their gains as June draws to a close. The S&P 500, Nasdaq, and Dow all touched new highs this week, shrugging off persistent geopolitical noise and pockets of overvaluation.

What's fueling this seemingly chilled-out rally? A combination of softer inflation impulses and revived optimism around a potential Fed rate cut as early as September or even July. Adding fuel to the dovish narrative are growing rumors of a potential replacement for Fed Chair Jerome Powell later this year, possibly with a more accommodative successor.

Markets: US Futures continue to climb, European equity indices follow the US rally while China is lagging - US interest rates drop - profit taking in commodities and metals.

My view: This market feels almost too relaxed. With volatility compressing and equities grinding higher, Wall Street seems to have entered a phase of “detached optimism.” The cooling in oil prices and dovish Fed signals are enough to keep the party going for now, but complacency is creeping in.

From a strategic point of view, this sets up a tricky dynamic:

On one hand, the path of least resistance remains up, especially if institutional investors feel pressure to chase returns into quarter-end.

On the other hand, valuation risks are accumulating, particularly in tech-heavy indices that are already priced for perfection.

I remain cautiously tactical here, not chasing highs. The next meaningful market move may hinge on whether the Fed’s dovish tone translates into actual policy action, and on how Q2 corporate earnings shape expectations for the second half.

Let’s also not forget the unresolved tariff and trade negotiations, with a fast-approaching deadline on July 8. For now, summer calm prevails, but beneath the surface, key catalysts for renewed volatility are quietly gathering momentum.

Yesterday’s equity market action presented a rare and telling pattern. During European trading hours, indices reflected the signature of significant institutional flows. Was a major bank offloading equities throughout the day?

Markets: European indices steadily declined throughout the day, with US equities following suit. US indices managed to break free from this downtrend in the final hour of trading.

My view: Despite a high number of economic and geopolitical uncertainties, markets are approaching record highs. This recent rally has been predominantly driven by retail investors, with institutional investors largely sitting on the sidelines. The critical question in the coming days or weeks is which camp will prove correct. Retail investors, fueled by the so-called TACO trade (Trump Always Chickens Out) and speculation, bought heavily during the post-correction bounce after “Liberation Day.”

How will institutional investors respond? Will they be forced to chase these rising indices at record levels, potentially fueling a further rally? Or, given current valuations, will they use these elevated levels as an opportunity to continue reducing risk in their portfolios? Based on my experience working with large financial institutions, yesterday’s market action pointed to a significant seller in equities, unloading throughout the day.

As the deadline for the suspended tariffs approaches, we should expect market sensitivity to this issue to resurface. These tariffs were put on hold for 90 days and have largely been out of the spotlight for the past 80 days.

Reflecting on my own positioning, I admittedly did not follow the retail crowd and missed out on the recent upside, anticipating further downside as discussed in my previous views. The market, however, appears unprepared for the looming tariff concerns. This underpricing of risk is why I expect higher volatility in the near future, with the potential for a downside correction. Q2 earnings will likely serve as the next key catalyst, driving the market in one direction or another based on the results.

This morning, US President Donald Trump announced a ceasefire in the Middle East. However, tensions remain high as Iran fired another round of missiles at Israel, claiming this would be the final round before the ceasefire takes effect. In response, Israel launched missiles at Iran. Both countries are already accusing each other of violating the ceasefire.

Markets: Equities move higher, oil prices slump together with volatility - US dollar weaker together with US yields - Cryptos spiked already yesterday night now trading sideways - gold gives up some ground

My view: A sharp drop in oil prices together with volatility, combined with rising equities, suggests that investors are cheering already about a final resolution to the conflict. However, the ceasefire appears fragile, as both Israel and Iran are already accusing each other of breaching it. The situation remains highly uncertain, and while fears of oil supply disruptions may be seen already priced out, the conflict has not been fully resolved. For now, the risk of a major escalation seems to have diminished, but the situation is far from settled.

Speculative money is clearly driving the markets. Looking at the currency markets, they tell a slightly different story as both, the Swiss franc and Japanese yen, show further strength against major pears, signaling ongoing safe-haven demand from investors.

Despite the ceasefire, the probability of volatility spikes and oil price fluctuations remain high.

In addition to the ongoing Middle East conflict, markets took note of recent remarks from two U.S. Federal Reserve Governors. Both signaled support for a rate cut as early as the next FOMC meeting in July.

Currently, the market still sees September as the most likely timing for the first rate cut.

Markets: US equities rebounded, supported by improving risk appetite and a sharp decline in oil prices. Bond yields fell, while gold and cryptocurrencies advanced, reflecting a broader shift into risk and inflation-sensitive assets.

My view: Both dovish Fed members, appointed by Donald Trump, have added momentum to early rate-cut expectations. Their remarks pushed the probability of a July rate cut to around 25%, up from 15% just days earlier. Still, for most market participants, September remains the base case.

At this stage, it’s too early to call a clear direction. Uncertainty remains high, and the full impact of recent geopolitical and macro developments is still unfolding. Upcoming data, especially inflation and labor market figures released early in July will be decisive.

Also worth watching: July 9, when Trump is expected to announce his decision on reciprocal tariffs. Another potential market mover that could shape the Fed’s path forward in either direction.

Following Trump’s announcement just two days ago, what was expected to take "weeks" materialized within 48 hours. Last night, the United States launched airstrikes on Iran’s nuclear enrichment facilities.

In response, Iran fired missiles at Israel.

Markets: Weekend stock futures are trading sharply lower, down 1 to 1.5% (Hang Seng, Dax, Nasdaq) - Cryptocurrencies are also under pressure. While Bitcoin is holding relatively firm with a 2% decline, altcoins are seeing significantly steeper losses.

My view: What is next after the US strikes? The key question now: Will Iran escalate further, perhaps by targeting regional US assets or disrupting oil flows through the Strait of Hormuz? Such a move would mark a dangerous turn, with direct implications for global energy prices and shipping routes. What is the role of Russia going to be in this widening conflict? It continues to be an unpredictable situation.

As a consequence, volatility may rise, and while equities could suffer a short-term hit, the full market impact will depend on the scope and duration of this conflict. Today, Israels stock index reached a new high. It seems like investors are betting that this conflict ends rather soon.

The conflict between Israel and Iran is intensifying, with both sides continuing their military strikes and leaders trading increasingly aggressive rhetoric. According to sources familiar with the matter, senior US officials already prepared plans for a potential strike on Iran in the coming days. However, President Donald Trump indicated last night that he intends to give Iran some time, stating he will decide within two weeks whether to proceed with military action. Meanwhile, Russia has warned that any US involvement could trigger “a terrible spiral of escalation.”

Markets: trends from last days seem to reverse, with a pause in the oil price rally - global equity markets in plus after being down during the last days

My view: Oil prices have firmed significantly, driven by geopolitical risk and concerns over regional supply chain disruptions. However, so far this spike is expected to have only the short to mid-term nature as OPEC+ nations are stepping in by increasing the output. The US, as a self-sufficient oil producer, remains largely insulated from direct supply shocks.

Once again, it's Europe that faces the brunt of rising energy prices. Its heavy reliance on oil imports leaves the continent exposed to renewed inflationary pressures and the risk of another economic drag, just as some recovery signals had started to appear.

Overall, this conflict adds another layer of uncertainty to an already fragile environment. The development is highly unpredictable.

By now, I see my portfolio well positioned, maintaining also an allocation to energy stocks. There’s little value in trying to front-run headlines in such a situation. I will only react decisively if meaningful developments show clear potential for whether a tactical short-term trade or a broader allocation shift.

One constant remain: volatility isn’t going away anytime soon.

This morning, the Swiss National Bank (SNB) cut its key interest rate by 25bps, in line with market expectations.

Markets: Swiss equities declined by 1%, already trading lower ahead of the announcement - Swiss government bond yields ticked slightly higher - Swiss franc strengthened further

My view: There had been speculative positioning for a surprise 50bps cut, betting on a weaker Swiss franc, which ultimately did not materialize.

Given the backdrop of heightened uncertainty and rising geopolitical tensions, I expect the Swiss franc to remain firm and potentially appreciate further. This supports my decision to maintain full currency hedges against both the euro and the US dollar.

The era is back of losing money by holding Swiss bonds in the portfolio.

With the policy rate now at 0% and Swiss government bonds yielding negative returns out to four years, many domestic investors are holding fixed income assets with negative real performance. In this environment, remaining invested in Swiss bonds is effectively a zero-sum game. Even worse when factoring in transaction costs, custody fees, and income taxes on coupon payments.

While there is still a small chance of capital gains should rates decline further, the risk-return profile of Swiss bonds remains deeply unattractive. For now, staying on the sidelines in this asset class, holding cash instead, appears the more rational choice. Nevertheless, many Swiss institutions continue to keep their clients invested, a decision that seems more aligned with securing custody fees than serving investors' best interests.

Very insightful to follow Fed Chair Jerome Powell’s press conference last night. Beyond the official statement and published protocol, the Q&A session offered several notable takeaways.

For me, one of the most striking remarks: “Tariffs are going to end higher than forecasters see.”

Currently, market consensus assumes an average tariff rate of 13%. But reality may prove more severe. China is already facing 55% tariffs, the UK 10%, and there are still no additional trade deals on the table.

Powell was clear on inflationary risks:

“Everyone I know is forecasting a meaningful increase in inflation in the coming months due to tariffs because someone has to pay and some of it will fall on the end consumer.”

He elaborated that the pass-through effect from tariffs takes time:

“Goods being sold in stores today may have been imported months ago, before tariffs were imposed. We're only beginning to see the impact — and more will show up in the months ahead.”

Markets: US markets closed today, trading US Futures are negative - global equity markets are broadly lower - US dollar an Treasury yields moved higher - gold losing some ground - Cryptos are trading sideways

My view: The recent stream of some positive economic data may be misleading, as tariffs move through in a slower process the economy. There is delayed impact.

While Fed officials currently “don’t see signs” of a weakening US economy, Chairman Powell acknowledged that growth will inevitably slow. In other words: stagflation is no longer a distant tail risk, it’s becoming an increasingly plausible base case.

For a forward-looking Fed, the toxic mix of persistent inflation and decelerating growth presents a growing challenge. Yet markets may still be underestimating both the scale and the endurance of tariffs as a structural headwind.

With geopolitical tensions, particularly in the Middle East, dominating headlines, trade policy risks are drifting out of the spotlight. But the trade front remains unresolved, which adds to the Fed’s uncertainty and complicates the macro outlook.

Investors might be underestimating the impact and how high tariffs will ultimately go. No additional trade deals have been struck, and attention has clearly shifted away from trade politics. But this complacency could prove costly once tariffs re-enter the spotlight with full force.

This is why I maintain a portfolio allocation geared toward higher volatility and broader market shifts, with rising risks skewed to the downside.

This week is packed with key central bank decisions, keeping investors on edge.

Bank of Japan and Sweden’s Riksbank have already left their interest rates unchanged, in line with expectations.

Tonight, all eyes are on the US Federal Reserve (Fed), where the market broadly anticipates no change in interest rates.

Tomorrow, the Swiss National Bank (SNB) is expected to cut rates by 25bps. However, the SNB has a history of surprises. A deeper cut of 50bps, effectively returning to negative rates, cannot be fully ruled out.

Also on Thursday, the Bank of England (BoE) will announce its decision. Today’s inflation print supports the consensus for no rate change.

Markets: Investors remain cautious, with equities trading sideways on low volume, reflecting a classic “wait-and-see” approach ahead of the policy signals. Same for US dollar currency, commodities and interest rates

My view: Rising geopolitical tensions, fragile trade negotiations, and mounting political pressure—particularly from Donald Trump, who continues to push for lower U.S. interest rates—are adding layers of complexity to central bank decision-making. A rate change at tonight’s meeting would be a major surprise.

Investor attention is on the Fed’s policy statement and protocol. Despite persistent inflation, markets still price in one to two rate cuts by year-end. However, the recent rebound in energy prices could prompt a more hawkish tone from the Fed, potentially catching markets off guard. This increases the risk of a sharp reaction across bonds, equities, and gold. Risk of higher volatility is clearly elevated heading into the announcement.

China: as released yesterday, retail sales surged by 6.4% YoY in May, well ahead of the expected 5% and accelerating from April’s 5.1%. It marked the fastest pace since late 2023, supported by government subsidies aiming to stimulate domestic demand. However, industrial output growth slowed to 5.8%, slightly below expectations and down from 6.1% in April, reflecting the strain of lingering trade uncertainties and deflationary pressures.

US: In contrast, US retail sales declined 0.9% MoM in May, far worse than the -0.6% consensus and following a -0.1% drop in April. Excluding autos, sales still fell 0.3%. Weakness was broad-based: autos -3.5%, gas stations -2%, restaurants -0.9%. Only online (+0.9%) and furniture stores (+1.2%) showed some resilience.

Markets: US Futures down, China stock indices down after yesterday’s small bounce; US dollar and interest rates little changed; gold slightly positive while major cryptos fall.

My view: Recent consumer data underscores a widening gap between China and the US in consumption dynamics.

For now, China's consumer is rebounding, helped by targeted policy support and still-depressed comparison bases. However, the economic environment remains challenging to maintain stable growth since the second quarter, naming heightened uncertainty in trade policies among factors dragging growth.

Meanwhile, the US consumer is turning more selective, if not outright cautious. After front-loading purchases in March, particularly autos, ahead of anticipated tariffs, May data confirms a pullback. Airlines inform that they are facing weaker travel demand. Tariff concerns, rising energy prices, and cautious consumer sentiment clearly weighed on spending. With inflation-adjusted wages barely moving and geopolitical tensions rising, households are rethinking their priorities.

With the overall situation (high valuations after recent rally) and the escalation in the Middle East area to continue, I remain selective and rather cautious. Expecting some drawdown and higher volatility ahead, I took measures in recent weeks benefitting from falling stock indices and rising volatility.

However, I keep my allocation in China internet and consumer stocks.

In case of positive signs, I will add more exposure in China and buy some global retail stocks which saw lately sharp declines.

Israel launched a series of airstrikes on Iran early Friday local time, marking a significant escalation in the ongoing tensions between the two nations. Israel confirmed it targeted sites linked to Iran’s nuclear program. Iran’s state media reported multiple fatalities in Tehran, including the death of the commander-in-chief of Iran's Islamic Revolutionary Guard Corps. Additionally, media reports indicate that Iran has launched over 100 drones toward Israel in retaliation.

Markets: oil-prices surged by 7-8%, currently trading up +5%; risk-off and safe haven stance, equity indices declining globally, Swiss franc and Japanese yen have strengthened while US Treasury yields have fallen; Cryptos are deeply in red while gold sees an up-tick.

My view: Amid an already more fragile picture of the global economy outlook, with heightened uncertainties, this conflict adds another layer of risk that undermines the potential for sustained market optimism. If the situation escalates further, oil prices are likely to remain elevated for an extended period. Rising energy costs could intensify inflationary pressures, while simultaneously weighing on global growth, presenting significant headwinds for economic stability.

This scenario would certainly prevent any potential for higher stock prices.

Following a high-level meeting in London, the US and China reached a new trade agreement aimed at preserving the fragile truce established in Geneva. President Donald Trump announced that US tariffs will be maintained at 55%, while China will hold its own at 10%. The deal includes the removal of Chinese export restrictions on rare earth minerals and lifts curbs on magnets vital for high-tech and defense industries. It also reopens access for Chinese students to US universities.

Cantor Fitzgerald CEO Howard Lutnick noted the deal's importance in securing supply chains for critical minerals, while Bessent clarified that no ‘quid pro quo’ had been made regarding U.S. high-end chip exports in return.

Markets: Major Asian markets down with Hang Send index -1.36%, European equities down between -0.5% to -1%, US Futures slightly down -0.3%; falling yields on interest rates globally, while US dollar continues to drop; gold price stagnate with other commodity prices; Cryptos see some profit taking

My view: For some, it may be surprising that markets did not cheer the news. But the reality is more sobering. The “deal” essentially confirms that tariffs are not being lifted. Tariffs are being cemented at a slightly lower level. The narrative is being spun as progress, but in fact, it institutionalizes a new baseline of trade friction between the world’s two largest economies. And this will also count for other trade partners which have not yet settled a deal.

To keep in mind, the US is forced to generate income to find a balance on its bill and the gap with financing its debt and lower taxes .

While short-term disruptions may ease, the structural decoupling continues. Investors have priced in a rebound with full normalization. This deal framework should definitely raise red flags.

The euphoria built on hopes of resolution may begin to unwind once investors realize the tariffs are not going away. It’s not a rollback, it's a realignment. And sooner or later, that will be felt in corporate margins, supply chains, earnings guidance as well as economic data like inflation, slowdown labor market.

I took some profit on investments done recently, few days after the ‘Liberation Day’ during market lows. On the other hand I increased my position betting on rising volatility as well as increased my exposure towards falling stock prices in the chip sector. Investors were heavily betting that the export restrictions will be eased with this deal.

Today’s reported inflation numbers came in lower than expected. The CPI (Consumer Price Index) rose 0.1% for the month of May, below the 0.2% estimate, with an annual increase of 2.4%, below the 2.5% consensus estimate.

Core CPI, which excludes food and energy, rose 0.1% on the month, cooler than the 0.3% expected reading. And the year-over-year increase was 2.8%, below the 2.9% estimate.

Markets: US stock futures initially cheered the softer data with US equity futures surging ahead of the opening. During regular trading hours, major indices gave back some of those gains, hough they remain in positive territory; US dollar weakened alongside falling yields, with the 10-year yield dipping from 4.5 to nearly 4.4%; positive price reaction on gold and cryptos.

My view: The headline inflation numbers may look contained for now, but underlying cost pressures are building and could resurface in the second half of the year.The CPI report delivered a positive surprise, and under normal conditions, this would have triggered a more sustained market rally. Adding to the bullish narrative is the news of a trade agreement between the US and China—potentially easing tensions around critical materials and tariffs. But after the sharp rally in recent weeks, markets appear overbought. Today’s news, while constructive, is no longer enough to fuel another major leg higher. A correction seems both healthy and overdue.

While a broader tariff escalation has been delayed as negotiations are still on-going, the real impact may surface in the coming months as companies preemptively hike prices. With imports from China fell sharply for two consecutive months, there are currently no news on product shortages. But, rising commodity prices, especially in metals and oil, are likely to lead to inflation to some extent.

The US and China are set to resume trade talks. Negotiators re-meet today in London for a second round of trade and tariff talks.

Before, Trump accused China to violate the trade deal. The talks follow now a phone call last week between Presidents Donald Trump and Xi Jinping.

The talks aim to resolve issues such as rare-earth exports, tariffs, and restrictions on advanced chip technology.

Meanwhile, Chinese exports to the U.S. fell sharply in May, plunging 34.4% year-on-year, the steepest drop since the pandemic lockdown in 2020.

China exports were up 4.8% in May (est. 5.0%) while imports dropped 3.4% (est. -0.9%).

Markets: China up this morning, while US is trading sideways after a positive opening; Commodities are a clear winner with gold, silver, copper, platinum all extended their recent uptrend; the US dollar edges lower;

My view: Investors seem again rather optimistic on US China talks. Any progress remains tentative.

While the US China talks may continue to keep headline risk temporarily down, the underlying strategic competition remains intact, particularly in the race for critical minerals and technological dominance.

I therefore already increased significantly on April 7th the exposure in commodities as well as mining stocks, adding rare earths and later in May gold exposure, all implemented via ETF.

With the current backdrop and the my view that the race for resources continues bring higher prices, I keep the increased tactical allocation in that specific sector.

Any negative outcome of the latest talks could lead to a sharp drop in overall markets and higher volatility. Especially as overall negotiations and trade deals with different countries seem to stuck. Time is running, either reciprocal tariffs are set on hold or would take effect soon. The market is currently pricing in that deals with all nations will be found and tariff issues are going to be solved. I continue to see high level of risk that the market and investors are going to be disappointed as well as negative economic data will be released soon.

The tensions between Donald Trump and Elon Musk appear to be escalating. All started with some background noise. Trump is reportedly frustrated with Musk's growing political influence and refusal to fully endorse him. According to U.S. media reports, Trump has privately criticized Musk’s ambitions. In return, Musk has amplified posts mocking Trump and reiterated that X (formerly Twitter) will not be used as a campaign mouthpiece for any candidate.

Musk used the platform to criticize US debt levels and fiscal mismanagement, topics that intersect with Trump’s legacy and current campaign talking points. “Bankrupting America is NOT ok! KILL the BILL.” Musk posted on X last Wednesday. And added “If the massive deficit spending continues, there will only be money for interest payments and nothing else!”

Markets: Tesla stock slumped, losing 17% in two days, dragging down Nasdaq index yesterday - this morning with a shy rebound

My view: Frankly, I am not surprised to see Trump and Musk clashing. It is a confrontation I anticipated from the very beginning of their brief “collaboration” around the White House. Their egos, ambitions, and platforms were bound to collide.

I have been short Tesla since 20 May 2025, selling the stock at USD 353.63. A move I communicated to ETFMandate Premium Members via the Premium Newsletter.

Tesla’s fundamentals remain weak at this stage, and now political headwinds are intensifying. I am following this feud closely, as it could impact the stock sharply in either direction in the short term.

However, if tensions escalate further, the fallout could extend beyond Tesla, dragging down parts of the broader market, especially if Trump directly targets Musk-led businesses.

Markets continue to ignore the mounting debt challenges the US may face sooner or later, along with the growing warning signs. The latest USD 1.5 trillion spending plan only adds fuel to the fire. This complacency will not last forever. When the sentiment shifts, it could trigger a far deeper market correction.

This feud is more than just a personal spat. It has the potential to reshape also the political landscape. The next flashpoint? The unfolding battle over control of the social media narrative. What’s next in the battle between the Trump and Musk over the social media platforms? This story is far from over.

Today at lunchtime, the European Central Bank (ECB) will announce its latest interest rate decision. Markets widely expect a 25 basis point cut, bringing the key rate down to 2.00%. This would mark the ECB’s eighth rate cut in the current cycle since June 2024.

Markets: European equity indices are slightly up this morning with the DAX trading near its all-time high (reached yesterday); European interest rates are moving sideways as well as the Euro trading slightly above 1.14 against the dollar.

My view: A 25bps cut is fully priced in, so a market driver could be the ECB’s forward guidance during the press conference when President Christine Lagarde comments on the economic outlook, inflation expectations, and maybe giving a hint on the future rate path.

Markets have run up significantly in recent weeks, leaving room for a potential correction, especially if the ECB’s tone disappoints or fails to confirm dovish expectations.

Meanwhile, yesterday’s Fed minutes already pointed to signs of a weakening US economy. As previously noted, markets continue to shrug off negative data. Therefore the critical question is, how much longer?

Today’s ADP employment report revealed a sign of weakness in the US labor market. The private sector added only 37’000 jobs in May. This is well below expectations of 115’000, following the slowing trend since the start of the year and marking the slowest pace since March 2023.

At the same time the sentiment in the US services sector unexpectedly deteriorated in May with the Service PMI at 49.9 and below the 50 threshold, now indicating a potential contraction (consensus estimate 52).

Markets: DAX with new all-time high, US indices up led by Tech stocks +0.3%, US dollar weaker with declining interest rates, gold +0.6%, Swiss Franc and Japanese Yen stronger against major currencies (safe haven demand?)

My view: Despite weak labor data, signals through leading indicators of potential economic weakness, now even in both, the manufacturing and the service sector, markets remain remarkably resilient. To my surprise, investor sentiment shows no real vulnerability, highlighted by the German DAX hitting fresh all-time highs today.

This market strength, in the face of multiple headwinds like geopolitical risks, unresolved trade disputes, and historically high debt levels, suggests that momentum-based strategies continue to dominate. Algorithms appear programmed to keep buying, irrespective of the economic backdrop.

We are witnessing a growing disconnect between markets and fundamentals, an environment driven more by speculation than by earnings or economic reality. investors leverage levels have surged again, now matching the extremes last seen before the 2001 dot-com bust and the 2008 starting subprime crisis. That, to me, is a major red flag.

Yet, as history has shown, periods of irrational exuberance can persist far longer than expected. A high number of today’s rather new market participants have never experienced a prolonged downturn. Their confidence in rapid recoveries, reinforced by past aggressive central bank interventions, could make the eventual correction all the more painful. When the tide turns, the “young gambling crowd” may face a reality check. I suspect it will take an unprecedented catalyst to bring this cycle to a more severe and lasting end.

The latest global manufacturing PMI (Purchase Manager Index) data for May 2025 paints a cautious picture, with signs of stabilization in parts of Europe but notable weakness in Switzerland, the US, and China, largely due to escalating trade tensions and tariff impacts.

Purchasing Manager Index: based on a monthly survey of supply chain managers across multiple industries, covering upstream and downstream activity. The Purchasing Managers' Index can range between 0 and 100, with a number over 50 citing expansion and under 50 noting contraction.

In the Eurozone the Manufacturing PMI edged up to 49.4 in May from 49.0 in April, marking the slowest pace of contraction in nearly three years. This improved number was mainly driven by Spain's manufacturing sector returning to growth in May, with the Manufacturing PMI rising to 50.5 from 48.1 in April. However, Germany's manufacturing sector continued to contract, with the PMI slightly decreasing to 48.3 in May from 48.4 in April, marking the 35th consecutive month below 50.

Fort the export focused country Switzerland, the manufacturing PMI plummeted to 42.1 in May from 45.8 in April, the lowest reading since late 2023. The decline reflects collapsing production, dwindling orders, and escalating trade barriers. Over half of surveyed firms cited trade barriers as a core constraint, signaling significant challenges for the sector.

China's manufacturing sector contracted in May, with the Caixin/S&P Global Manufacturing PMI falling sharply to 48.3 from April's 50.4, the lowest in 32 months.

The United States manufacturing sector showed mixed signals in May. The S&P Global Manufacturing PMI rose to 52.3, indicating expansion, while the ISM Manufacturing PMI registered at 48.5, suggesting contraction. The divergence reflects varying assessments of the sector's health amid ongoing trade tensions and tariff impacts.

Markets: Global equities do not show big reaction on these numbers: China up this morning, US indices closed higher yesterday, Europe trading almost unchanged; long-term interest rates, after latest rally in May on the way to decline further with the 10-year US Treasury moving towards 4.4%, gold in consolidation after yesterday’s strong move.

My view: This could just be the beginning that the effects of trade tensions and tariffs are about to manifest in the manufacturing data. The strong figures previously observed were likely influenced by front-loading activities, such as Switzerland's Q1 GDP boost from increased pharmaceutical exports to the US, growing 2% year-on-year basis. However, with investments being put on hold and deliveries now missing in this second quarter, the underlying economic challenges are becoming more apparent.

For such a scenario, equity indices ran too far up, even with potential interest rate cuts. Investors are increasingly hopeful that the Federal Reserve (Fed) might initiate interest rate cuts sooner than the anticipated September timeline. However, some analysts caution that the Fed's commitment to its 2% inflation target may lead to a more measured approach, especially given the potential inflationary impact of recent tariff policies.

Legal, economic, and political uncertainties are intensifying under President Trump.

Just one day after accusing China of violating a key trade agreement, Trump announced a doubling of tariffs on imported steel and aluminum, from 25% to 50%, effective June 4.

Tariffs continue to dominate headlines, with hardly a week passing without a new development. This week, the issue moved into the courts. Legal challenges now question the legitimacy of reciprocal tariffs and whether the authority to impose them lies with the President or Congress. Both parties have until June 9 to present their arguments.

At the same time, June will be pivotal for global monetary policy. Decisions are due from the ECB, the Federal Reserve, and the Bank of Japan. Meanwhile, the Swiss National Bank could surprise markets with a reintroduction of negative interest rates.

Inflation remains persistently high in both Europe and the US, and new tariffs may add further upward pressure.

Markets: Weekend futures across Asia, Europe, and the US are pointing lower. Cryptos are also trading lower, suggesting a weak opening to the new trading week.

My view: Markets are navigating a sea of uncertainties. Yet, despite escalating trade tensions and a steady stream of negative news, investor sentiment remains remarkably upbeat. The market continues to shrug off potential downside risks, especially on the tariff front.

A key reason: many investors are still betting on the so-called “TACO” trade - ”Trump Always Chickens Out”. This strategy is built on the assumption that Trump may posture aggressively but ultimately softens or reverses his stance. That belief helped fuel one of the strongest months for US equities in May, the best since November 2023.

I chose not to follow that speculative crowd. From my perspective, the economic impact of recent policy decisions is already more severe than markets are pricing in. Valuations appear increasingly stretched. The real question is: what will break the current euphoric mood? And how long will speculators continue to chase elevated valuations in the face of mounting structural risks?

On Wednesday, the U.S. Court of International Trade in New York ruled that nearly all of the tariffs imposed under Trump’s invocation of emergency economic powers were unlawful.

However, by Thursday, the US Court of Appeals in Washington temporarily overturned the New York ruling, granting only a provisional stay. The appellate court has now called for all parties involved to submit further legal arguments by June, signaling that the final verdict on the legality of Trump’s tariffs remains unresolved.

Markets: Equity indices continue with wider swings, Europe up today, while US Futures are trading flat, Asia in red this morning; Cryptos trading down, while US dollar is up and gold price trading around USD 3’300/os level.

My view: Tariffs remain a dominant topic, with uncertainty intensifying following the latest legal developments. As anticipated in my previous post, published yesterday, the market euphoria proved short-lived.

The rapid reversal of the court’s ruling underscores the ongoing legal and policy uncertainties surrounding US trade measures.

This back-and-forth creates significant challenges for companies operating globally, making it difficult to plan ahead.

Until a clear legal outcome is reached, the uncertainty around tariff policy will likely continue to weigh on investment decisions, many of which are now being set on hold and for sure being delayed. This hesitation will sooner or later show up in economic data and, in turn, will effect market sentiment in a negative way.