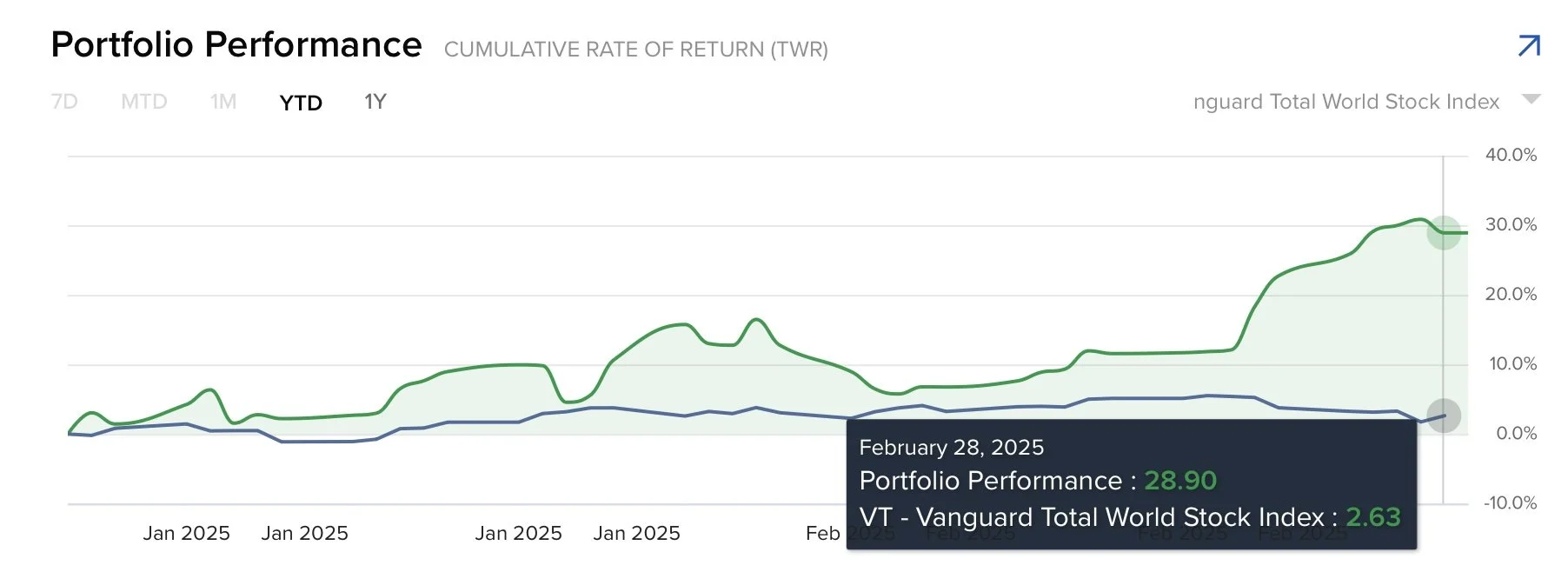

01.03.25 - ETFMandate Portfolio - Outstanding February performance

After an already strong and exceptional January with over 12%, I achieved yet another impressive performance in February:

Portfolio Performance YTD: +28.90% (28.02.2025)

Market Performance:

ACWI* +2.83%

DAX +13.27%

Nasdaq -2.31%

Source: IBKR, 01.03.2025

Another outstanding month!

Primary performance drivers, a high weight on China's tech stocks while the portfolio was tactically well positioned to capitalize on the burst of the AI bubble in the US through short positions in the most crowded stocks. Additionally, the U.S. dollar has been hedged since its peak in mid-January, preventing the portfolio from major currency losses. Bonds and commodities also ended the month in positive territory.

Long-term value stock investments contributed nicely to performance, while some U.S. small caps and positions in the hydrogen sector faced challenges.

Markets: While China’s stock market and Europe saw rising stock prices, the US saw some sell-off together with India and Japan. Interest rates declined. US dollar traded lower. Cryptos saw heavy decline. Gold reached a new all-time high.

My view: I am very satisfied with the performance achieved so far, recognizing that the past two months have been rather exceptional.

Bubbles do not burst every day. However, when they do, they trigger exceptionally strong market moves. As an independent investor and with the technical available set-up, As an independent investor, equipped with the right technical setup, I can react swiftly to market dynamics, including capitalizing on falling stock prices through short selling.

While the exact timing of a bubble’s burst is unpredictable, I began building short positions as early as mid December last year, anticipating that the event was approaching. Since then, I have progressively increased and added short positions in skyrocketing stocks, particularly in the tech and artificial intelligence (AI) sectors.

The bursting of a bubble is a rare event, often leading to sharp and rapid downturns. Some stocks plunged by 30 to 40% within just two to three days. Being well-positioned at such a moment is the most significant contributor to performance, as investors scramble to exit simultaneously.

*MSCI all Countries World Index

Become a member to access more valuable market updates like this.